"The slowdown in housing prices as reflected in the latest ABSA House Price Index report is concerning not only for the property sector but for our entire economic outlook," said Colin Fibiger, CEO of Propertyt Network.

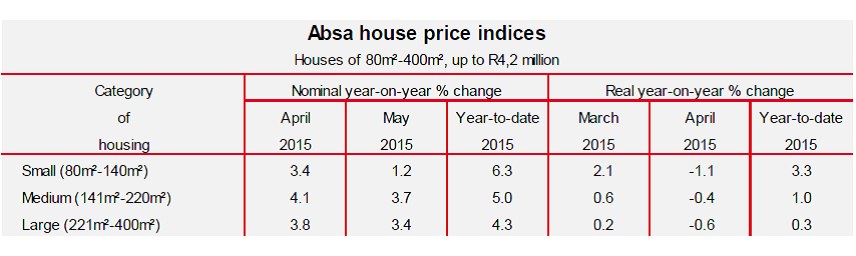

According to the report, released on 8 June, year-on-year growth in the average nominal value of homes in the various categories of middle-segment housing in the South African residential property market slowed down further across all categories of housing in May 2015. Taking account of the effect of inflation, some real house price deflation was evident in each category of housing in April compared with a year ago.

The ongoing declining trend in month-on-month house price growth of the past number of months also contributes to the slowdown in year-on-year price growth. Some marginal nominal month-on-month price deflation has already occurred in some segments of the market over the past few months. In real terms, house prices were on average still down by more than 11% in April this year compared with the peak in August 2007.

The average nominal value of homes in each of the middle-segment categories was as follows in May 2015:

- Small homes (80mē-140mē): R832 000

- Medium-sized homes (141mē-220 mē): R1 190 000

- Large homes (221mē-400mē): R1 864 000

He raises further concerns that coupled with aggresive infaltion factors and the pressure on interest rates, we could well see the property sector become stagnant until late 2016.

The current downward trend in house price growth, which started in October last year, came on the back of trends in economic growth, inflation, interest rates, consumer credit-risk profiles and levels of confidence, as well as the prospects for these and other macroeconomic and household sector-related factors in the rest of the year. In view of these developments and expectations, nominal house price growth is forecast to average around 6% in 2015, down from 9,4% in 2014 and 10% in 2013.

Based on trends in and the outlook for the factors driving headline consumer price inflation, which is already showing some upward pressure as a result, domestic interest rates are forecast to be hiked before the end of the year and through 2016 to curb inflation. Against the background of the inflation rate expected to rise to a level of above the upper limit of the inflation target range of 3%-6% towards year-end and in the first half of 2016, real house price growth is forecast to be under severe downward pressure in the coming twelve months, with a strong probability of prices deflating in real terms during this period.

Back

to Main News page

Back

to Main News pageYou Might Also Want to Read These

Concern over continued mismanagement at NMB Municipality

Warren Buffet Backs Property Market